Learn About Florida Real Estate With Bruce Griffy

Realtor® Bruce Griffy with the Amerivest Realty team has more than 20 years of experience in the Florida real estate market. We work hard to empower clients and simplify the process, and we're excited about our blog page, featuring helpful tips and pertinent updates. Catch up on recent news then contact us to get started with our professionals!

Understand Your Credit Score

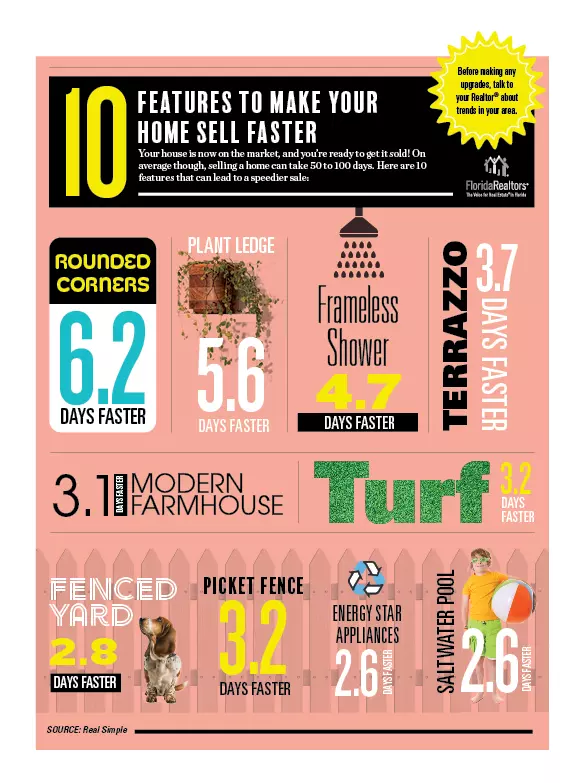

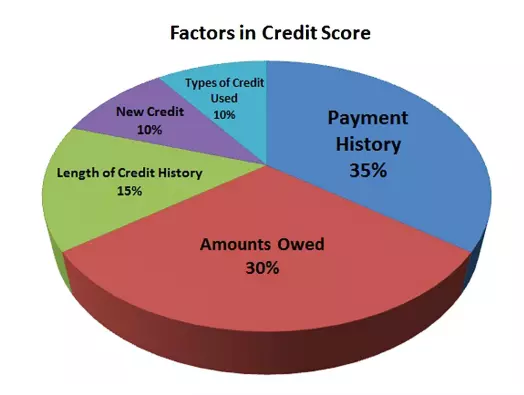

Did you know that credit scores are calculated differently for a mortgage loan? Every online service and industry use different scoring models to come up with a credit score that would be used to determine an interest rate or the ability to get a loan. Whether it's a home, a car, or a department store, they all use different methods to determine credit worthiness. The most widely recognized score is the Fair Isaac Corporation “FICO Score”, which is the industrial leader and has been providing credit scores since 1956. Other scores you may have heard of include Vantage Score, Experian, Equifax and TransUnion. The credit reporting agencies Experian, Equifax and TransUnion all have their own ways of scoring, and all are often different because they each have their own proprietary software that creates the credit score. To make it more difficult, each bureau generates a different credit score for a particular industry. For example, if you had your credit report pulled by an auto dealer, a cable company, a department store, and a mortgage company on the same day, you would be amazed by the wide discrepancy among the different scores. The Mortgage Company credit scores are the most conservative because of the amount of credit that is usually required to purchase a home. Because of this, you should always get pre-approved by a Mortgage Lender. Through the pre-approval process, not only will you get a valid credit score established, but you will know exactly how much you can spend on your Home Purchase. A Pre-Approval is better than a Pre-Qualification letter. A Pre-Qualification Letter, is determined by the Mortgage Lender viewing your credit report and making a decision, while a Pre-Approval takes into account Income, Debt and Expenses. If you are serious about buying a home, put your mind at ease and get Pre-Approved! You should always get a copy of your credit report every year. Federal Law allows you to request a free copy of your credit report once a year from each of the three bureaus by going to annualcreditreport.com. Although a credit score is not provided on the report, you can verify the accuracy of what is being reported and dispute items that are incorrect or clear up any outstanding issues like collections. Bottom Line, get your Free Credit Report, even if you think you are in good shape. Being prepared before home shopping will make the process smoother and quicker.

Historic Boost in Troops' Housing Allowance 2023

Housing allowances for troops are jumping by 12.1%, on average, in 2023, defense officials announced Wednesday. That’s the largest year-over-year percentage jump in the Basic Allowance for Housing in at least 15 years. Many Service Members have been hit hard over the last few years by the increased cost of housing. The percentage increase in BAH varies by rank, location and whether the service member has dependents. New rates take effect Jan. 1. Troops can look up their new BAH amount for 2023 by plugging in their rank and zip code in the DoD tool. Of the 300 designated military housing areas, 291 will see increases in BAH; five will see decreases, and four will stay the same. Those with decreasing rates are Lake Charles, Louisiana (down by 10%); Holloman Air Force Base/Alamagordo, New Mexico (down by 4%); Vance Air Force Base/Enid, Oklahoma (down by 2%); Long Island, New York (down by 2%) and Buffalo, New York (down 1%). Troops stationed in areas where the amount of housing allowance decreases aren’t penalized; they continue to receive the same amount they received in 2022. Areas where the BAH will stay the same are San Francisco; Erie, Pennsylvania; Memphis, Tennessee; and Bismarck, North Dakota.

Down Payment Assistance for Retired Veterans Moving to Florida

The Florida Hometown Heroes Housing Program Makes Homeownership Affordable for Eligible Veterans. This program provides down payment and closing cost assistance for all Active Duty Military Members and Veterans. You must qualify and purchase a primary residence. You DO NOT have to be a first-time homebuyer! The Florida Hometown Heroes Loan Program also offers a low first mortgage rate and additional special benefits to those who have served and continue to serve their country. Down Payment and Closing Cost Assistance to income-qualified Homebuyers up to 5% of the First Mortgage Loan Amount (maximum of $25,000), in the form of a 0%, non-amortizing, 30-year Deferred Second Mortgage. Veterans Retiring and Moving to Florida are Eligible! This Second Mortgage becomes due and payable, in full, upon sale of the property, refinancing of the first mortgage, transfer of deed or if the Homeowner no longer occupies the property as his/her primary residence. County Loan Limits- Okaloosa & Walton-FHA/USDA $539,350 Conv/VA $647,200 Bay-FHA/USDA $420,680 Conv/VA-$647,200 County Income Limits- Okaloosa-$131,850 Walton-$118,950Bay-$118,950 The Florida Hometown Heroes loan is not forgivable.To Help Get You in Your New Home, I will Personally Rebate Up to $5000 Towards Your Closing Costs at Closing if You Use Me as Your Agent When Buying a Home! Rebate Amount is Based on Purchase Price. Contact Me Now For More Information 850-460-0704 Hometown Heroes Housing Program

Categories

- All Blogs (51)

- 1031 Exchange (2)

- downpayment assistance (3)

- first-time homebuyers (18)

- florida homes (33)

- Golf Course Homes (1)

- Home Maintenance (3)

- Home Safety (6)

- Homeownership (43)

- Hurricane Preparedness (3)

- Increase your home value (3)

- Landscaping Tips (2)

- mortgage (8)

- real estate investors (7)

- Real Estate Taxes (4)

- tips for buyers (22)

- tips for sellers (11)

- tips for seniors (15)

- veterans (20)

Recent Posts