Full Disclosure, I am not an Attorney or Certified Public Accountant. I have many clients who have sold and purchased investment properties using a 1031 Exchange (or like-kind exchange). A 1031 Exchange is the exchange of one business or investment property for another. Most Exchanges of this nature are taxable as sales, but if this section of the US Internal Revenue Code applies, the tax on the capital gains can be deferred into the replacement entity. There would be no tax or limited tax due at the time of the Exchange. This allows your investment to grow, tax deferred.

The most common application of the 1031 Exchange is for Real Estate, but can also apply to other investment and business assets as well. As long as the money continues to be re-invested on a like-kind entity, the capital gain taxes can be deferred.

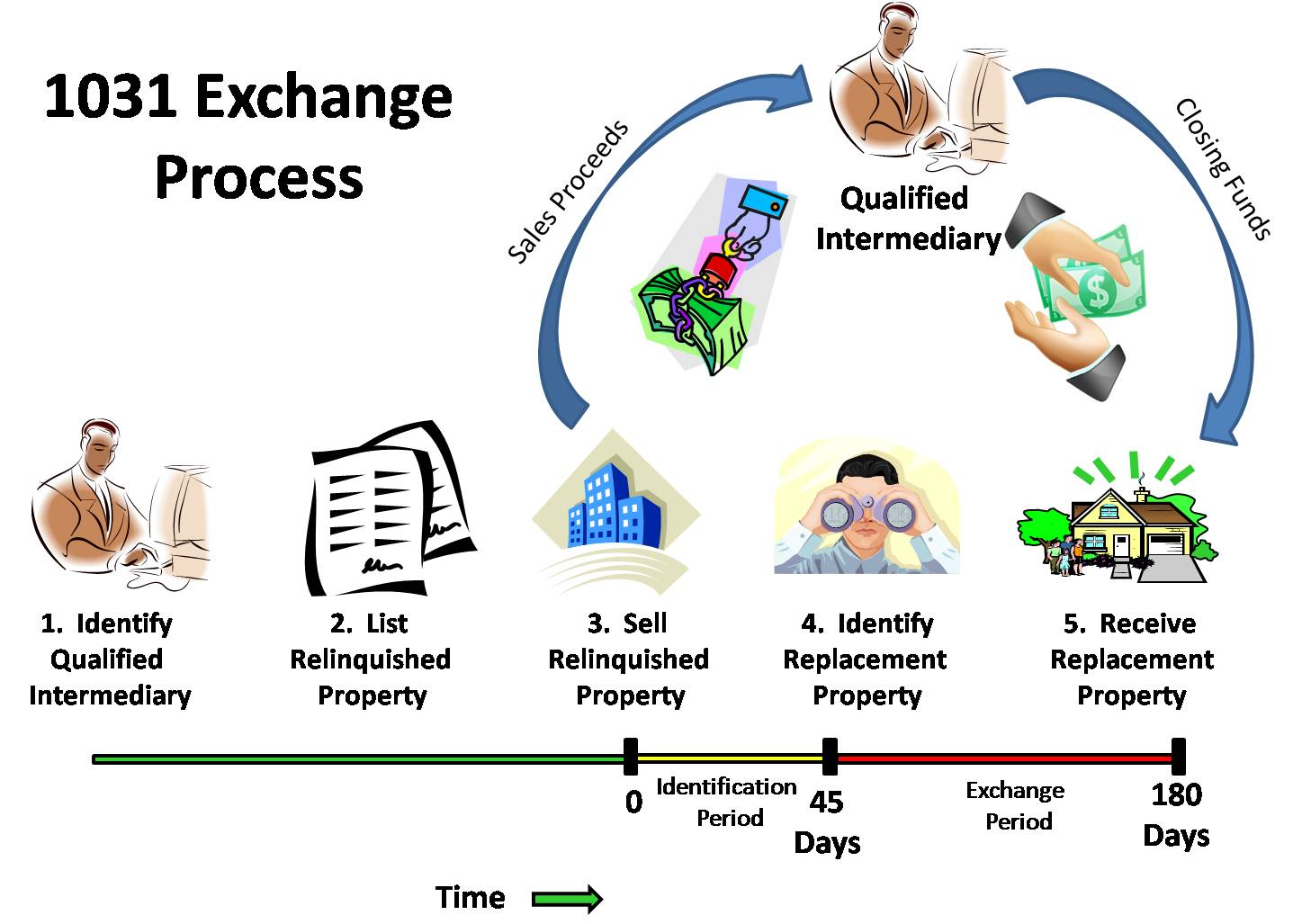

The simplest version of a 1031 Exchange is a simultaneous exchange of investment assets. Non-simultaneous Real Estate Exchanges are also allowed. This allows you to dispose of a property and then subsequently acquire one or more like-kind replacement properties. The replacement property has to be identified within 45 calendar days of closing on the relinquished property and close on the replacement property within 180 calendar days of the relinquished property closing.

1031 Exchange Rules and Requirements

1. Same Taxpayer- The name on the tax return and on the title to the property must match.

2. Property Identification- Post closing of the first property (relinquished property), you have 45 calendar days to identify to either the replacement property or the addresses of the potential replacement properties. Three property rule, 200% rule and 95% exception rules apply.

3. Replacement- You have 180 days from the relinquished property closing to close on the replacement property. The 180 day clock starts when you close on the relinquished property or when the tax return was filed, which ever is earlier.

4. Trading Up- Your replacement property has to be worth more than your relinquished property. Equity and debt have to be equal on both properties. Please talk to your CPA.

5. Hold Time- There is no hold time in the 1031 code, but two years is a good lookback period. A quick turnaround 1031 Exchange will raise a red flag with the IRS. If this is a rental property, you can only use it 14 days for personal use. If you go beyond that, it becomes a second home.

6. Related Party- The term "related party" means any person or party, including entities, that has a relationship to the taxpayer described in Section 267(b) or Section 707(b)(1) if the Internal Revenue Code.

Please consult your Attorney or Certified Public Accountant for more information.