Learn About Florida Real Estate With Bruce Griffy

Realtor® Bruce Griffy with the Amerivest Realty team has more than 20 years of experience in the Florida real estate market. We work hard to empower clients and simplify the process, and we're excited about our blog page, featuring helpful tips and pertinent updates. Catch up on recent news then contact us to get started with our professionals!

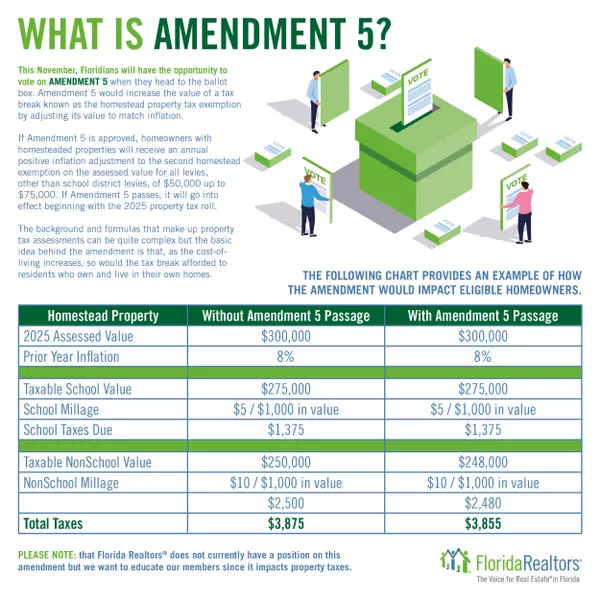

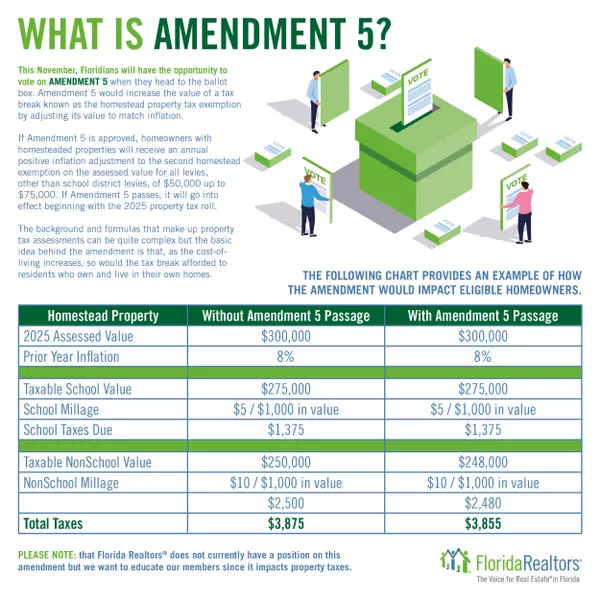

What is Amendment 5?

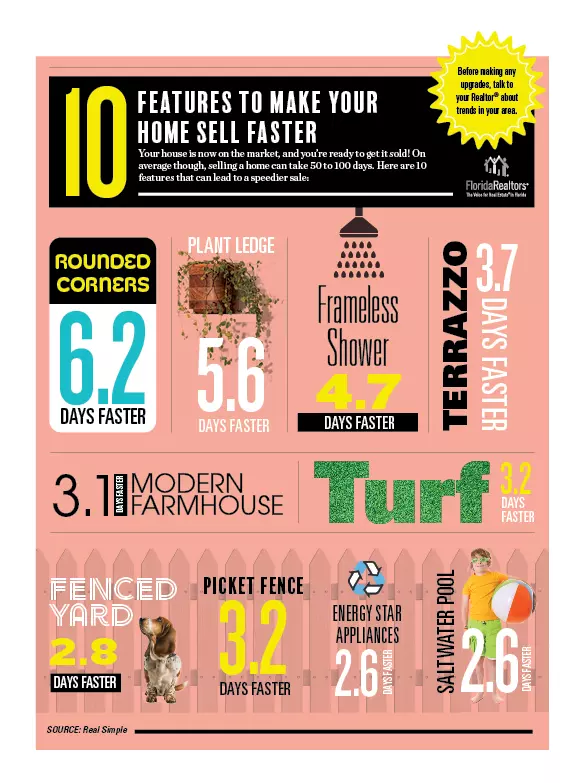

Amendment 5 is on the ballot for Floridians. Amendment 5 would increase the value of a tax break known as the Homestead Property Tax Exemption by adjusting its value to match inflation.

A Good Time For Real Estate Investors to Sell

As Rental Rates slow and decelerate it's a great time for Real Estate Investors to Sell. Till now, rents have risen and home price appreciation has been exceptional. In the past three years rental rates have soared 17% while typical home prices have increased 35%, depending on the area. All of this was taking place when interest rates were low. Homes prices are now going down along with rental rates. We also have a 40-year high in multifamily construction which means thousands of rental units will be hitting the market in upcoming months and the next year driving down rental rates. Sales Inventory for Existing Homes is at about 1 million, a historic low. It would take 100% growth to reach adequate supply. This is where Real Estate Investors can help the market and themselves with a tidy profit. Why chance losing equity and lower rental income? Some organizations are calling for a federal incentive to help bring needed inventory to the market in the form of capital gains relief to real estate investors who sell to first-time home buyers. The problem with this theory, most first-time home buyers who haven't already purchased a home wouldn't qualify with the current interest rates. If we desperately need inventory on the market, give capital gains relief to real estate investors without restrictions. Are you ready to Sell your Investment Property? Give Me a Call!

Florida Homestead Property Tax Exemptions At Risk if You Are Renting Rooms

If you are renting out part of your home or run a small business from your home, you could lose your Homestead Property Tax Exemption and be charged with penalties and back taxes. View here for more information!

Categories

- All Blogs (51)

- 1031 Exchange (2)

- downpayment assistance (3)

- first-time homebuyers (18)

- florida homes (33)

- Golf Course Homes (1)

- Home Maintenance (3)

- Home Safety (6)

- Homeownership (43)

- Hurricane Preparedness (3)

- Increase your home value (3)

- Landscaping Tips (2)

- mortgage (8)

- real estate investors (7)

- Real Estate Taxes (4)

- tips for buyers (22)

- tips for sellers (11)

- tips for seniors (15)

- veterans (20)

Recent Posts