Understand Your Credit Score

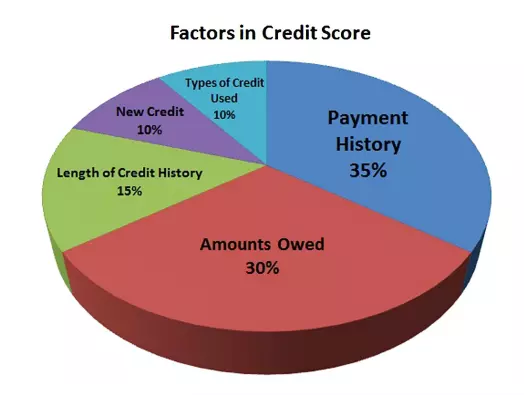

Did you know that credit scores are calculated differently for a mortgage loan? Every online service and industry use different scoring models to come up with a credit score that would be used to determine an interest rate or the ability to get a loan. Whether it's a home, a car, or a department store, they all use different methods to determine credit worthiness.

The most widely recognized score is the Fair Isaac Corporation “FICO Score”, which is the industrial leader and has been providing credit scores since 1956. Other scores you may have heard of include Vantage Score, Experian, Equifax and TransUnion. The credit reporting agencies Experian, Equifax and TransUnion all have their own ways of scoring, and all are often different because they each have their own proprietary software that creates the credit score.

To make it more difficult, each bureau generates a different credit score for a particular industry. For example, if you had your credit report pulled by an auto dealer, a cable company, a department store, and a mortgage company on the same day, you would be amazed by the wide discrepancy among the different scores. The Mortgage Company credit scores are the most conservative because of the amount of credit that is usually required to purchase a home.

Because of this, you should always get pre-approved by a Mortgage Lender. Through the pre-approval process, not only will you get a valid credit score established, but you will know exactly how much you can spend on your Home Purchase. A Pre-Approval is better than a Pre-Qualification letter. A Pre-Qualification Letter, is determined by the Mortgage Lender viewing your credit report and making a decision, while a Pre-Approval takes into account Income, Debt and Expenses. If you are serious about buying a home, put your mind at ease and get Pre-Approved!

You should always get a copy of your credit report every year. Federal Law allows you to request a free copy of your credit report once a year from each of the three bureaus by going to annualcreditreport.com. Although a credit score is not provided on the report, you can verify the accuracy of what is being reported and dispute items that are incorrect or clear up any outstanding issues like collections. Bottom Line, get your Free Credit Report, even if you think you are in good shape.

Being prepared before home shopping will make the process smoother and quicker.

Categories

- All Blogs (51)

- 1031 Exchange (2)

- downpayment assistance (3)

- first-time homebuyers (18)

- florida homes (33)

- Golf Course Homes (1)

- Home Maintenance (3)

- Home Safety (6)

- Homeownership (43)

- Hurricane Preparedness (3)

- Increase your home value (3)

- Landscaping Tips (2)

- mortgage (8)

- real estate investors (7)

- Real Estate Taxes (4)

- tips for buyers (22)

- tips for sellers (11)

- tips for seniors (15)

- veterans (20)

Recent Posts