Learn About Florida Real Estate With Bruce Griffy

Realtor® Bruce Griffy with the Amerivest Realty team has more than 20 years of experience in the Florida real estate market. We work hard to empower clients and simplify the process, and we're excited about our blog page, featuring helpful tips and pertinent updates. Catch up on recent news then contact us to get started with our professionals!

HB 59-Provision of Homeowners' Association Rules and Covenants

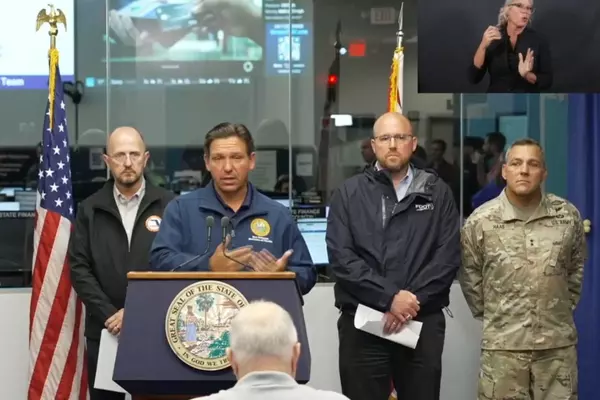

On May 29, 2024, Governor DeSantis signed HB 59 (2024) into law. Effective July 1, 2024, HB 59 (2024) amends Fla. Stat. Sec. 720.303 as follows: Requires an Association to provide a physical or digital copy of the Association’s rules and covenants to each member by October 1, 2024 and to each new

HB 1049-Flood Disclosure In The Sale of Real Property

This Bill goes into effect October 1, 2024 Gov. Ron DeSantis has signed a bill that could impact homeowners in the Florida Keys and other flood-prone ability to sell their homes. DeSantis signed HB 1049, which requires a flood disclosure in the sale of property in Florida. The law, which will go in

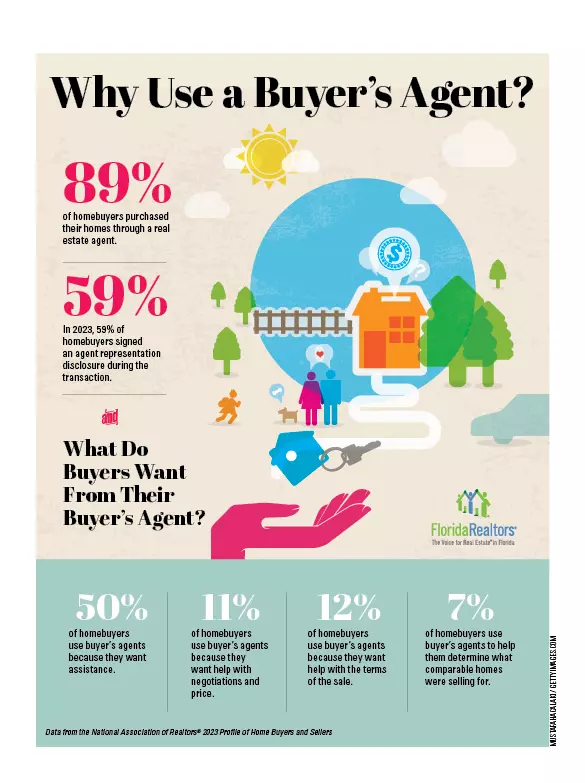

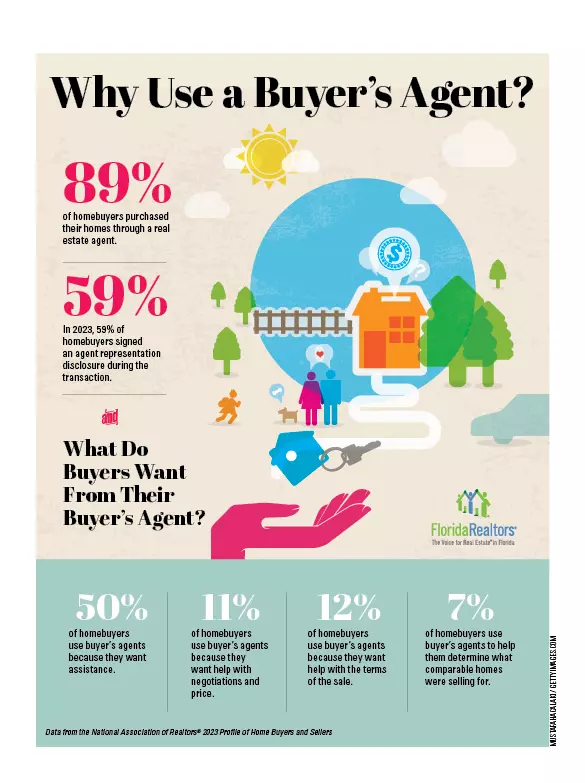

Why Use a Buyer's Agent?

Categories

- All Blogs (51)

- 1031 Exchange (2)

- downpayment assistance (3)

- first-time homebuyers (18)

- florida homes (33)

- Golf Course Homes (1)

- Home Maintenance (3)

- Home Safety (6)

- Homeownership (43)

- Hurricane Preparedness (3)

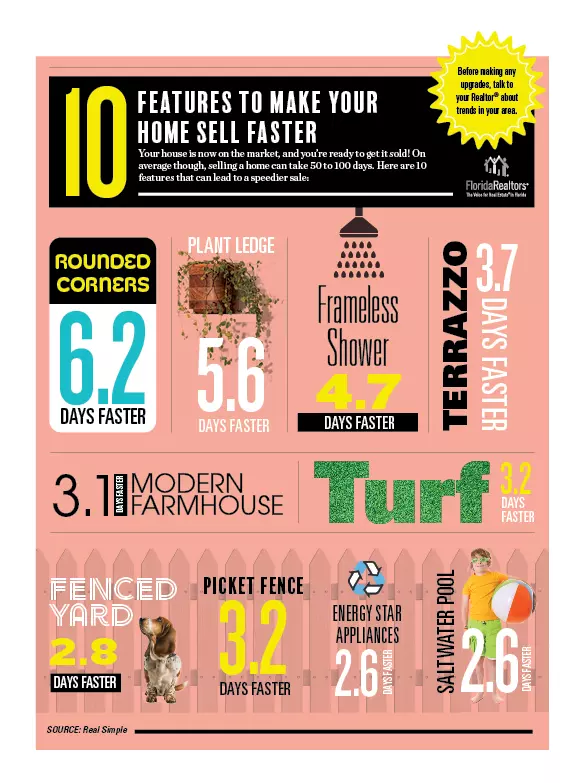

- Increase your home value (3)

- Landscaping Tips (2)

- mortgage (8)

- real estate investors (7)

- Real Estate Taxes (4)

- tips for buyers (22)

- tips for sellers (11)

- tips for seniors (15)

- veterans (20)

Recent Posts