Reasons Why Your Homeowners Insurance Policy Can Be Canceled

Storm risk is one reason insurance policies get canceled, but there are several other reasons your homeowners insurance policy can be canceled. Sometimes these reasons my not cancel your policy, but your premium will definitely go up.

The Most Common Reasons Include:

- Non-Payment of Premiums

- Risks of Wildfire in Your Area

- Lack of Home Maintenance- Tree limbs next to your home beating against your roof and siding causing damage which will allow water intrusion. Water damage is the number one loss, not just in Florida, everywhere. Anything connected to water should be well maintained which includes refrigerators, toilets, sinks, showers, tubs, water heaters and spas. You need steel braided hoses, not rubber hoses. Water heaters must have an overflow tank. Anything to prevent water damage is critical.

- Filing Too Many Claims

Now the Fun Stuff!

Unique Reasons Why Your Homeowners Policy is Canceled:

- Certain Dogs- Your policy usually covers injuries and property damage caused by your Dog. UNLESS, your dog belongs to a so-called restricted dog breed such as Pit Bulls, Rottweilers and Dobermans. Among the standard breeds that would likely cause a rate hike or policy cancellation includes Akita, American Pit Bull Terrier, Pit Bull, Chow Chow, German Shepherd, Great Dane, Rottweiler, Siberian Husky and the Wolf Hybrid. Some insurance carriers don't have breed restrictions, while certain state and local governments do.

- Exotic Pets- Snakes such as Boa Constrictors or Venomous Snakes (Illegal in Florida), Reptiles or even Ferrets. Insurance Carriers look at the risk factor. If you have an exotic pet or a dangerous dog, make sure you inform your insurance company. If you don't, you will be responsible for all related medical bills.

- Electric Vehicle Hookups- Installing a car charging station in your driveway or garage may affect your home insurance policy. Some states require home and condo owners to have liability coverage for the charging equipment, and some underwriters may require documentation that the equipment was installed by a professional. Talk to your insurance agent before adding a charging station to your home.

- Solar Panels- Many Florida Insurance Companies are canceling policies due to solar panels on the home. Electric Utility Companies are placing the burden on the homeowner if the solar panels cause any damage to the Electric Company. For instance, a surge running through the panels could cause damage to the grid or other homes. They will also deny coverage if you are selling power back to the electric company.

While an insurer can't cancel a single policy due to an increase in storm damage, it could stop writing policies in high-risk areas.

When in doubt, speak to your local insurance agent to understand coverage and limitations.

Categories

- All Blogs (51)

- 1031 Exchange (2)

- downpayment assistance (3)

- first-time homebuyers (18)

- florida homes (33)

- Golf Course Homes (1)

- Home Maintenance (3)

- Home Safety (6)

- Homeownership (43)

- Hurricane Preparedness (3)

- Increase your home value (3)

- Landscaping Tips (2)

- mortgage (8)

- real estate investors (7)

- Real Estate Taxes (4)

- tips for buyers (22)

- tips for sellers (11)

- tips for seniors (15)

- veterans (20)

Recent Posts

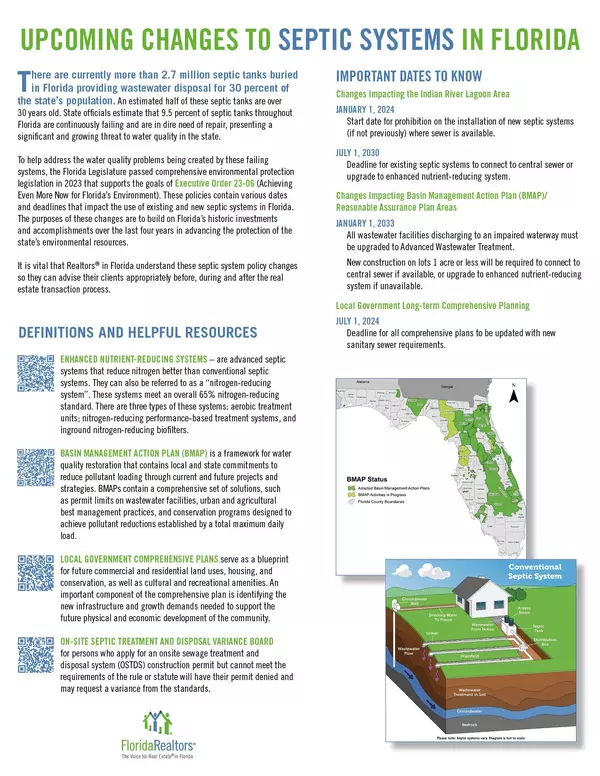

Upcoming Changes to Septic Systems in Florida

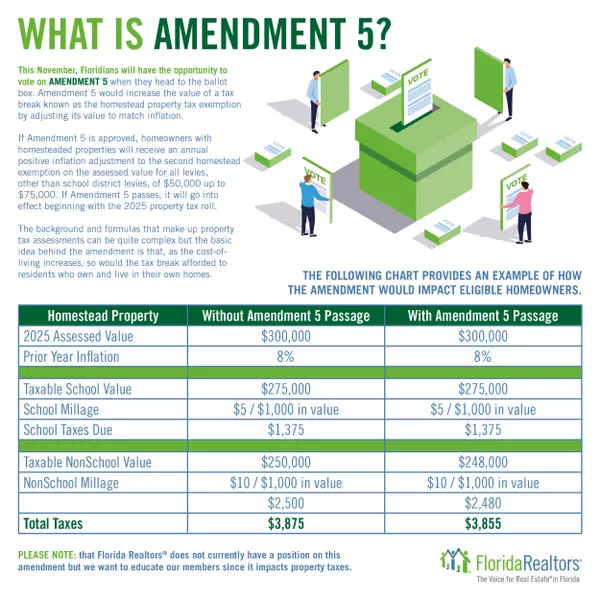

What is Amendment 5?

Damage From Your Neighbor's Tree

HB 59-Provision of Homeowners' Association Rules and Covenants

HB 1049-Flood Disclosure In The Sale of Real Property

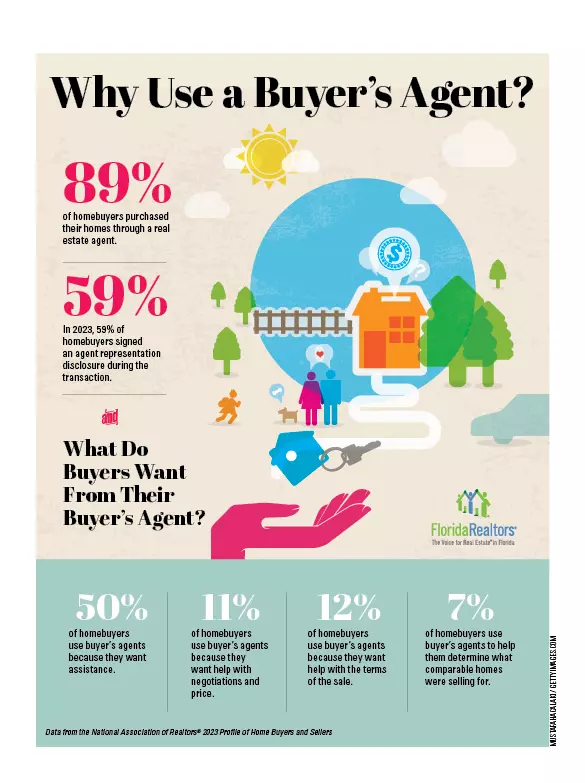

Why Use a Buyer's Agent?

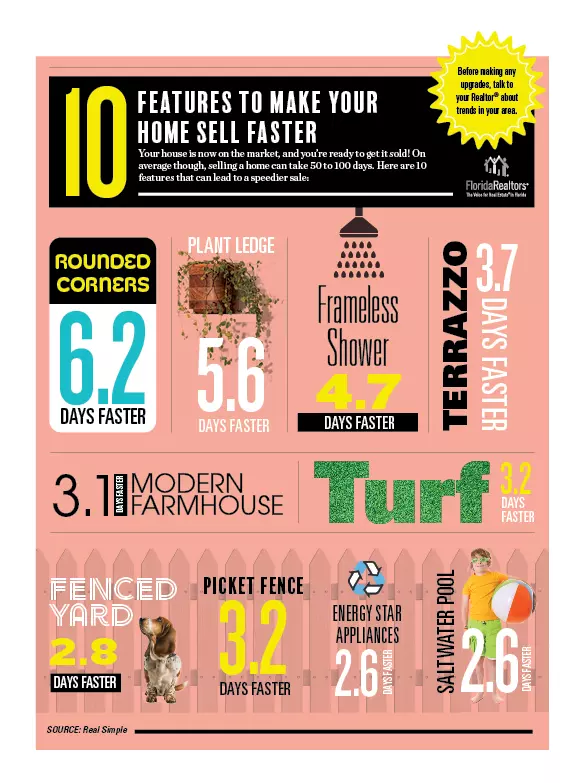

Sell Your Home Faster!

A Good Time For Real Estate Investors to Sell

Curb Appeal Pays Off When Listing Your Home

The Truth About Home Appliances

GET MORE INFORMATION

Follow Us