Learn About Florida Real Estate With Bruce Griffy

Realtor® Bruce Griffy with the Amerivest Realty team has more than 20 years of experience in the Florida real estate market. We work hard to empower clients and simplify the process, and we're excited about our blog page, featuring helpful tips and pertinent updates. Catch up on recent news then contact us to get started with our professionals!

Florida Homestead Exemption and Portability

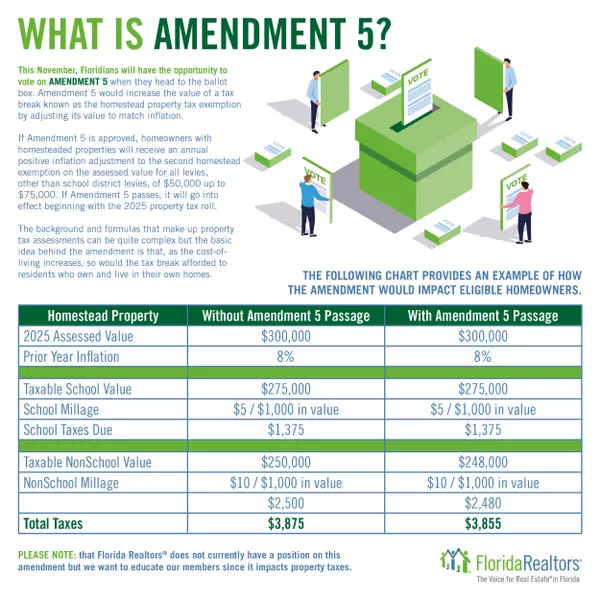

Homestead Exemption When Purchasing a Florida Home as your Permanent Residence, you can receive a Homestead Exemption up to $50,000. To be considered for this exemption, all applicants must file an application whether online, by mail or in person. A person who, on January 1, has legal title or beneficial title in equity to real property in the State of Florida and who in good faith makes the property his or her permanent residence is eligible. The deed or instrument granting ownership to the property must be recorded in the official records of Walton County. The following documentation is required, along with the in-office Homestead application: Recorded with the Clerk of Circuit Court evidence of ownership i.e., deed, contract, etc… Proof of social security numbers for all owners, e.g. social security card, W-2, tax return Valid Florida Driver’s License or Florida Identification Card with updated address All current State of Florida Vehicle Registrations with updated address Additional proof of residency can be: Voter Registration Card or Declaration of Domicile In addition to the information above, be prepared to answer and provide proof for the following: What is the physical address of the property? Did you have legal or beneficial title to the property on January 1? What date did you begin to claim the property as your primary residence? Do you have a valid Florida Driver’s License or Florida Identification Card and an additional proof of residency with the property address? What is your Citizenship status? Are you a US Citizen? If you are not a US Citizen, please provide a copy of your unexpired Permanent Resident Card. What is your social security number? What is your spouse’s social security number? Did you have a homestead exemption, in the State of Florida, anytime during the 2 previous tax years? Selling Your Current Florida Home and Buying a New Florida Home? Homestead Exemption cannot be transferred. Applicants must file an original Homestead application in office to apply for the homestead exemption on the new homestead. Homestead property owners are able to transfer their Save Our Homes (SOH) benefit (up to $500,000) to a new homestead within three years of giving up their previous homestead exemption. This is called Portability. If the just value of the new homestead is more than the previous home’s just value, the entire Save Our Homes cap value can be transferred. If the new homestead has a lower just value, the percentage of the accumulated benefit may be transferred to the new homestead. A Transfer of Homestead Assessment Difference application will be completed at the time you apply for Homestead on your new property in the county in which your new home is located. This form requires information about the previous homestead property. Applicants will need to know: the address, parcel ID number, county of previous homestead property, the date sold or no longer used as their homestead, all other owners of the previous homestead, and if any owners still reside there or if they are filing a new homestead.

Categories

- All Blogs (51)

- 1031 Exchange (2)

- downpayment assistance (3)

- first-time homebuyers (18)

- florida homes (33)

- Golf Course Homes (1)

- Home Maintenance (3)

- Home Safety (6)

- Homeownership (43)

- Hurricane Preparedness (3)

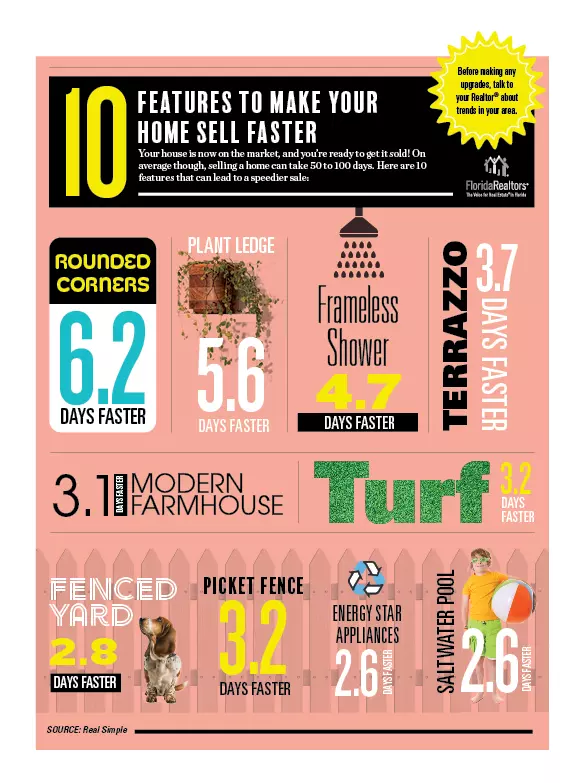

- Increase your home value (3)

- Landscaping Tips (2)

- mortgage (8)

- real estate investors (7)

- Real Estate Taxes (4)

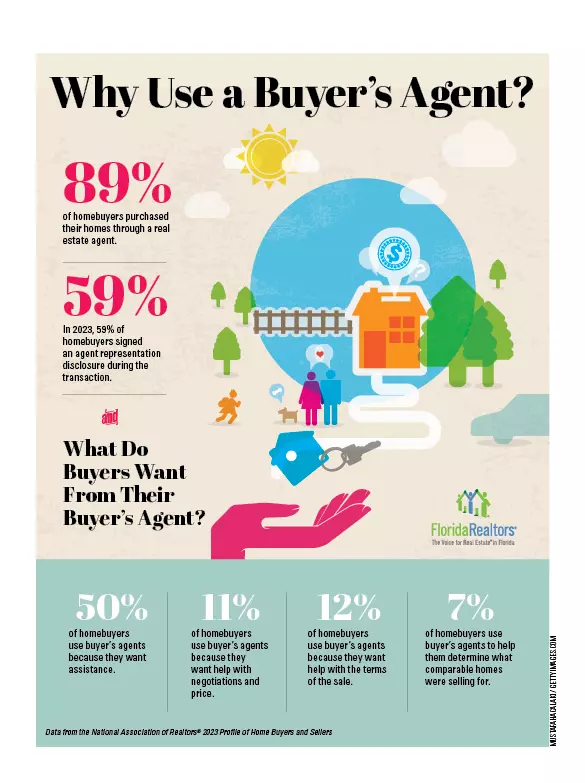

- tips for buyers (22)

- tips for sellers (11)

- tips for seniors (15)

- veterans (20)

Recent Posts