Learn About Florida Real Estate With Bruce Griffy

Realtor® Bruce Griffy with the Amerivest Realty team has more than 20 years of experience in the Florida real estate market. We work hard to empower clients and simplify the process, and we're excited about our blog page, featuring helpful tips and pertinent updates. Catch up on recent news then contact us to get started with our professionals!

Down Payment Assistance for Retired Veterans Moving to Florida

The Florida Hometown Heroes Housing Program Makes Homeownership Affordable for Eligible Veterans. This program provides down payment and closing cost assistance for all Active Duty Military Members and Veterans. You must qualify and purchase a primary residence. You DO NOT have to be a first-time homebuyer! The Florida Hometown Heroes Loan Program also offers a low first mortgage rate and additional special benefits to those who have served and continue to serve their country. Down Payment and Closing Cost Assistance to income-qualified Homebuyers up to 5% of the First Mortgage Loan Amount (maximum of $25,000), in the form of a 0%, non-amortizing, 30-year Deferred Second Mortgage. Veterans Retiring and Moving to Florida are Eligible! This Second Mortgage becomes due and payable, in full, upon sale of the property, refinancing of the first mortgage, transfer of deed or if the Homeowner no longer occupies the property as his/her primary residence. County Loan Limits- Okaloosa & Walton-FHA/USDA $539,350 Conv/VA $647,200 Bay-FHA/USDA $420,680 Conv/VA-$647,200 County Income Limits- Okaloosa-$131,850 Walton-$118,950Bay-$118,950 The Florida Hometown Heroes loan is not forgivable.To Help Get You in Your New Home, I will Personally Rebate Up to $5000 Towards Your Closing Costs at Closing if You Use Me as Your Agent When Buying a Home! Rebate Amount is Based on Purchase Price. Contact Me Now For More Information 850-460-0704 Hometown Heroes Housing Program

Invest in Your Future in Walton County Florida

Walton County is the No. 1 trending destination in America among travelers searching for Vacation Rentals, according to a recent Airbnb travel survey. The platform for vacation rentals and tourism activities cites the county's 26 miles of white sandy beaches, emerald gulf, four state parks and many galleries and restaurants as main drivers of Walton County's current popularity. What does this mean for you? It's time to invest in short term rental properties and second homes. Make money off a rental now, and retire here later. To check out your many options, give me a call!

Freddie Mac Helping First-time Homebuyers to Qualify for Purchase

Freddie Mac announced that it will increase homeownership opportunities for first-time homebuyers by considering on-time rent payments as part of the company’s loan purchase decisions. Beginning July 10, 2022, this automated functionality will be available to mortgage lenders nationwide through Freddie Mac Loan Product Advisor® (LPA), the company’s automated underwriting system. “This extremely important initiative will help many renters move closer to achieving the dream of homeownership,” said Michael DeVito, CEO of Freddie Mac. “Millions of American adults lack a credit score or have limited credit history. By factoring in a borrower’s responsible rent payment history into our automated underwriting system, we can help make home possible for more qualified renters, particularly in underserved communities.” With the borrower’s permission, lenders and brokers can submit bank account data for LPA to identify 12-months of on-time rent payments for inclusion in the tool’s assessment of purchase eligibility. The bank account data is obtained from designated third-party service providers using the same automated process used to verify assets, income and employment through LPA asset and income modeler (AIM). Eligible rent payment data includes check, electronic transactions or digital payments made through Zelle, Venmo or PayPal. These automated capabilities provide greater efficiencies to lenders and allows them to deliver a better borrower experience while continuing to meet Freddie Mac’s strong credit underwriting standards. “One of the first steps to purchasing a home is a positive credit history, and Freddie Mac is committed to helping consumers achieve that goal,” said Mike Hutchins, Freddie Mac President. “Our enterprise-wide approach already includes programs to help consumers understand credit and initiatives to assist renters with building and improving their credit scores. Factoring on-time rent payments into our automated underwriting system will help create even more opportunity for families across the nation.” Last year, Freddie Mac announced an initiative to help renters build credit by encouraging operators of Freddie Mac-financed multifamily properties securing its loans to report on-time rental payments to the three major credit-reporting bureaus. Since Freddie Mac began this initiative, 70,000 households across more than 816 multifamily properties have been enrolled. More than 15,000 new credit scores have been established, and 67% of renters with an existing credit score saw their scores increase. Additionally, the Freddie Mac CreditSmart® financial capability curriculum helps consumers learn about the importance of building, maintaining and using credit so they can take the reins on their financial futures. Over the past two decades, more than five million consumers at various life stages have benefitted from CreditSmart’s financial education, which is available at no cost.

Categories

- All Blogs (51)

- 1031 Exchange (2)

- downpayment assistance (3)

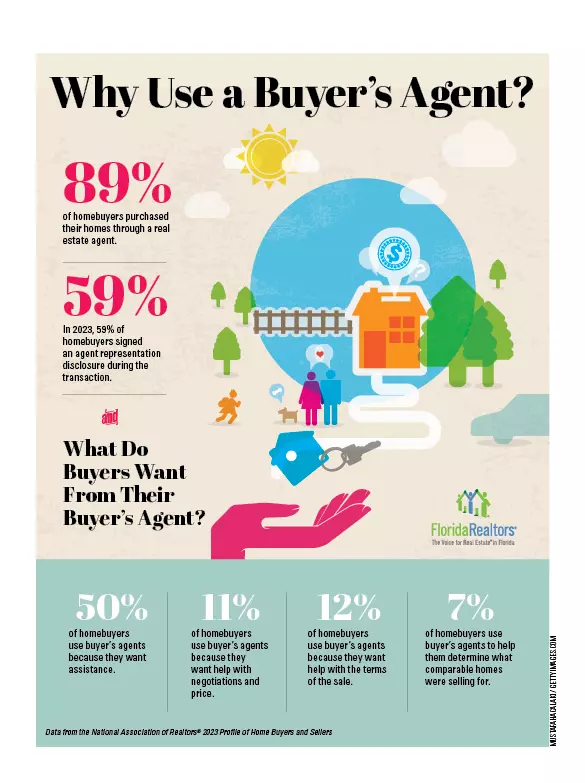

- first-time homebuyers (18)

- florida homes (33)

- Golf Course Homes (1)

- Home Maintenance (3)

- Home Safety (6)

- Homeownership (43)

- Hurricane Preparedness (3)

- Increase your home value (3)

- Landscaping Tips (2)

- mortgage (8)

- real estate investors (7)

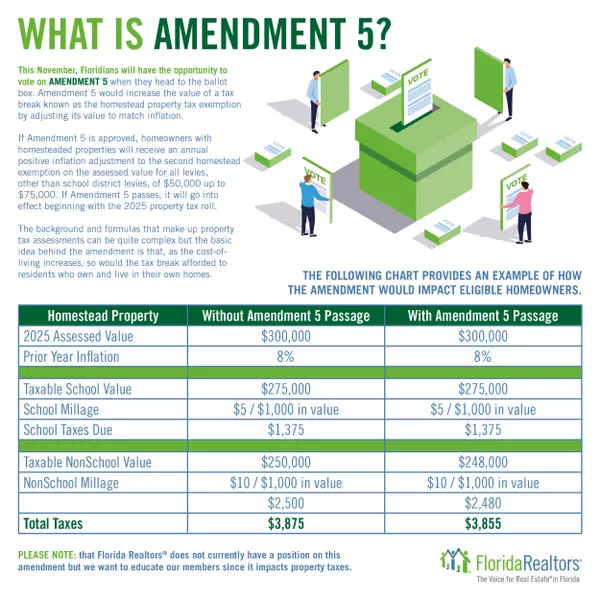

- Real Estate Taxes (4)

- tips for buyers (22)

- tips for sellers (11)

- tips for seniors (15)

- veterans (20)

Recent Posts